Unlock Funding: Bad Credit Debt Consolidation Loans Explained

Unsecured debt consolidation loans provide a flexible option for individuals with limited or poor cr…….

In the intricate world of finance, managing multiple debts can be a complex and daunting task for individuals and businesses alike. This is where Secured Debt Consolidation Loans emerge as a powerful solution, offering a strategic approach to debt management and financial stabilization. This comprehensive article aims to dissect the intricacies of secured debt consolidation loans, shedding light on their purpose, benefits, global reach, and the challenges they address. By exploring various facets, we will empower readers with valuable insights into this financial instrument, enabling them to make informed decisions regarding their debt obligations.

Secured Debt Consolidation Loans, also known as Consolidated Loan Secured by Assets, is a financial strategy where an individual or entity combines multiple debts into a single loan secured by specific assets. This method provides a structured repayment plan, typically with lower interest rates and extended terms compared to the original debts. The core components include:

The concept of debt consolidation has evolved over centuries, reflecting the changing financial landscapes and borrower needs. Historically, secured loans have been used for various purposes, including financing major purchases and business investments. However, the modern context of debt consolidation loans gained prominence during economic downturns and periods of high interest rates when borrowers sought relief from multiple high-interest debt burdens.

Secured debt consolidation loans play a significant role in:

Secured Debt Consolidation Loans have left an indelible mark on global financial markets, catering to diverse economic needs worldwide. Key influences include:

Regional trends reflect varying economic conditions and cultural attitudes towards debt:

| Region | Trend | Description |

|---|---|---|

| North America | Student Loan Consolidation Boom | The US market has seen a surge in student loan consolidation, with federal and private lenders offering attractive rates to ease the burden of student debt. |

| Europe | Mortgage Refinancing | Many European countries encourage mortgage refinancing to take advantage of lower interest rates, especially during economic downturns. |

| Asia Pacific | Digital Disruption | The rise of digital banking has made secured loan applications more accessible and efficient, attracting a younger demographic. |

| Emerging Markets | Microloan Consolidation | In regions with microloan cultures, consolidation offers a path to financial stability for small business owners burdened by multiple short-term loans. |

The Secured Debt Consolidation Loan market is influenced by several economic factors:

Lenders approach secured debt consolidation from an investment perspective:

Eligibility for Secured Debt Consolidation Loans varies by lender but generally includes:

The application process typically involves:

Sarah, a recent college graduate, accumulated substantial student loan debt across multiple lenders. She consolidated her loans into a single secured loan backed by her newly purchased car. This move lowered her interest rate and simplified her monthly payments, allowing her to focus on career development without the burden of overwhelming debt.

Mark, an aspiring entrepreneur, sought funding for his start-up. He secured a business loan using his commercial real estate as collateral, which provided him with the necessary capital for expansion while offering peace of mind due to the asset protection feature.

The digital revolution has significantly impacted the Secured Debt Consolidation Loan industry:

Lenders are increasingly adopting sustainable practices:

Secured Debt Consolidation Loans present a powerful tool for managing debt and achieving financial stability. By understanding their benefits, challenges, and global impact, individuals and businesses can make informed decisions to simplify their financial lives. As the industry continues to evolve, digital transformation and sustainable lending practices will shape its future, offering even more accessible and responsible borrowing options.

Unsecured debt consolidation loans provide a flexible option for individuals with limited or poor cr…….

Debt consolidation loans can be secured or unsecured. Secured loans offer lower rates but risk asset…….

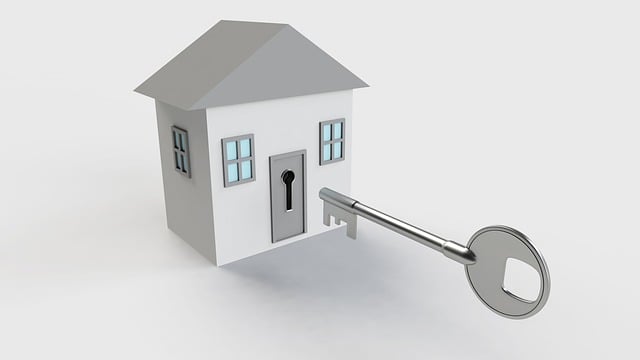

Secured Debt Consolidation Loans help homeowners merge multiple debts with lower interest rates and…….

Secured Debt Consolidation Loans offer UK residents a powerful tool to manage multiple debts by usin…….

Secured Debt Consolidation Loans bundle multiple high-interest loans into one single loan backed by…….

Unsecured debt consolidation loans provide a flexible way for individuals with less-than-perfect cre…….

Secured Debt Consolidation Loans streamline multiple high-interest debts by combining them into a si…….

Secured Debt Consolidation Loans in the UK provide a low-interest, extended repayment solution for m…….

Married couples with high-interest debts can find relief through Secured Debt Consolidation Loans, w…….

Unsecured loans and credit cards offer quick cash but come with high interest rates. Secured debt co…….

Secured Debt Consolidation Loans help homeowners merge multiple loans with lower interest rates, sim…….

Secured Debt Consolidation Loans offer a strategic solution for managing multiple high-interest unse…….

Struggling with multiple high-interest credit card debts? Secured Debt Consolidation Loans provide a…….

Unemployment often leads to high-interest debt from unsecured loans and credit cards. Secured Debt C…….

Unemployment and high debt go hand in hand, but Secured Debt Consolidation Loans offer a strategic s…….

Unsecured debt consolidation loans offer a flexible solution for individuals with bad credit aiming…….

Unsecured debt consolidation loans in the UK offer a flexible option for individuals with less-than-…….

Struggling with multiple personal loan and credit card debts? Debt consolidation could be the soluti…….

Unsecured consolidation loans provide an accessible path to debt management for individuals with bad…….

Secured Debt Consolidation Loans in the UK offer a strategic solution for managing multiple debts by…….

Secured Debt Consolidation Loans bundle high-interest debts into a single, lower-rate loan using col…….

Secured debt consolidation loans help married couples manage and reduce debts effectively by combini…….

Secured Debt Consolidation Loans use personal property as collateral to bundle high-interest debts i…….

In the UK, both unsecured and secured debt consolidation loans help manage multiple debts by offerin…….

Secured Debt Consolidation Loans streamline multiple high-interest debt obligations by using an asse…….

Secured Debt Consolidation Loans offer a strategic solution for managing multiple high-interest debt…….

Secured Debt Consolidation Loans combine multiple high-interest debts into one lower-rate loan, usin…….

Secured Debt Consolidation Loans offer a strategic solution for managing multiple debts by combining…….

Secured Debt Consolidation Loans help homeowners merge multiple debts into a single, more affordable…….

Secured Debt Consolidation Loans offer borrowers with strong credit a strategic solution to manage m…….

Secured Debt Consolidation Loans offer a path to financial freedom by simplifying multiple high-inte…….

Secured Debt Consolidation Loans empower borrowers by using an asset as collateral to consolidate mu…….

Debt consolidation loans in the UK offer either secured or unsecured options for managing multiple d…….

Secured Debt Consolidation Loans offer a strategic financial solution by bundling high-interest mort…….

Secured Debt Consolidation Loans combine multiple high-interest debts into one single loan with pote…….

Debt consolidation through secured or unsecured loans offers a strategic approach to managing multip…….

Married couples struggling with high-interest debt can improve their financial situation through Sec…….

Secured Debt Consolidation Loans streamline homeownership for individuals with substantial existing…….

Secured Debt Consolidation Loans bundle multiple high-interest debts into one manageable loan using…….

Secured debt consolidation loans leverage an asset like a home or vehicle as collateral to offer bor…….

Secured Debt Consolidation Loans in the UK offer a strategic solution for managing debt, particularl…….

Secured Debt Consolidation Loans offer individuals with bad credit a manageable debt solution by com…….

Secured Debt Consolidation Loans offer homeowners a strategic solution to simplify and reduce debt w…….

Secured Debt Consolidation Loans bundle multiple high-interest debts into a single loan, backed by a…….

Debt consolidation simplifies managing multiple debts by combining them into one loan with a lower i…….

Secured Debt Consolidation Loans bundle multiple high-interest credit card debts into a single loan,…….

Secured Debt Consolidation Loans in the UK offer a strategic solution for managing multiple secured…….

Secured Debt Consolidation Loans bundle multiple homeowner loans into one single loan with a reduced…….