Secured Debt Consolidation Loans offer homeowners a way to manage multiple high-interest debts by using home equity as collateral, potentially providing lower interest rates and a single, affordable payment. However, these loans carry significant risks, including the possibility of foreclosure if payments are missed, so thorough financial planning and disciplined repayment are crucial. Borrowers should research lenders and compare offers to find the best deal that aligns with their capabilities.

Struggling with high-interest debt but have a low credit score? Secured debt consolidation loans could be an option for homeowners seeking financial relief. This article explores secured debt consolidation loans tailored for those with less-than-perfect credit. We’ll guide you through the process, explaining the benefits and unique considerations of these loans. By understanding how they work, you can make informed decisions to simplify your finances.

- Understanding Secured Debt Consolidation Loans for Homeowners

- Benefits and Considerations for Low Credit Scores

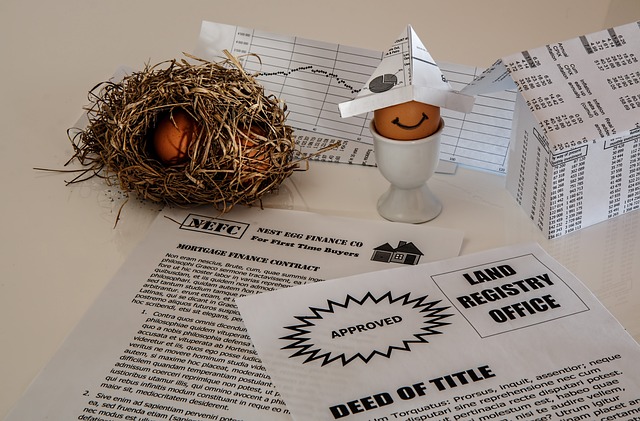

Understanding Secured Debt Consolidation Loans for Homeowners

Secured Debt Consolidation Loans for homeowners offer a strategic approach to managing multiple debts, especially for those with low credit scores. This type of loan is secured against the equity in your home, providing access to larger sums that can be used to pay off various high-interest debts, such as credit cards and personal loans. The appeal lies in the potential to reduce monthly payments significantly by consolidating debts into one fixed-rate loan.

These loans offer a safety net for lenders as they have collateral in the form of your home’s equity. This security often translates to more favorable interest rates compared to unsecured debt consolidation options. However, it’s crucial to understand that this type of loan carries a higher risk for homeowners since failing to make payments can lead to foreclosure. Therefore, thorough financial planning and discipline are essential before pursuing a secured debt consolidation loan.

Benefits and Considerations for Low Credit Scores

For homeowners with low credit scores, secured debt consolidation loans can offer several key advantages. These loans are a popular solution as they allow borrowers to combine multiple high-interest debts into one manageable payment. By consolidating debts, individuals can reduce their overall monthly outgoings and save money on interest charges. This is particularly beneficial for those struggling with a multitude of credit card debts or loans, enabling them to simplify their financial obligations.

When considering secured debt consolidation loans, it’s crucial to be aware of potential drawbacks. Lenders often require borrowers to use their homes as collateral, which means there is a risk of foreclosure if the loan isn’t repaid. Additionally, individuals with very low credit scores may face higher interest rates and less favorable loan terms. It’s essential for homeowners in this situation to thoroughly research different lenders and compare offers to ensure they get the best possible deal that aligns with their financial capabilities.

Secured debt consolidation loans can provide a viable option for homeowners with low credit scores seeking to manage their debts. By offering lower interest rates and flexible terms, these loans empower individuals to streamline multiple high-interest payments into one manageable installment. However, it’s crucial to weigh the benefits against potential drawbacks, such as the risk of losing collateral if repayment fails. Thoroughly evaluating your financial situation and exploring all available alternatives is essential before securing a loan, ensuring that debt consolidation aligns with your long-term financial goals.